Filing an income tax e-filing is not only a legal obligation for every citizen and business in India, but it is also a symbol of your financial honesty and transparency. By filing income tax returns, the individual or entity gives his annual income, expenses and tax details to the government. In today’s digital age, the Income Tax Department has made this process completely online, allowing taxpayers to easily file ITR sitting at home. In this direction, the ComputerMyTax platform, which started from Ahmedabad (Gujarat), is making tax filing simple, secure, and reliable.

💡 Why is it important to file an income tax return?

- Legal Responsibility: Under the Income Tax Act, every person whose income exceeds the prescribed limit is required to file ITR.

- Financial Transparency: Filing ITR keeps a record of your income and expenses with the government, which proves useful in case of any dispute in the future.

- Required for Loans and Visas: The ITR in a bank loan, credit card, or visa application for foreign travel becomes proof of your income.

- Mode of Obtaining Refund: If you have paid more tax, you receive a refund upon filing ITR.

- Helpful in Financial Planning: The record of ITR is helpful in planning your investments and savings for the future.

⚙️ Common Difficulties in Filing ITR

Although the process is online, many people still face the following problems:

- Complexity in Form Filling

- Difficulty of uploading the correct documents

- Lack of information on tax slabs and rebates

- Technical errors while claiming a refund

- Penalty for not filing on time

💻 ComputerMyTax: A Modern Online Solution

Keeping all these problems in mind, ComputerMyTax is a digital platform launched from Ahmedabad, Gujarat. It provides accurate, secure and fast tax filing service to the people with the help of experienced chartered accountants and tax experts.

Here you can easily fill from ITR-1 to ITR-5, ITR-U and TDS/TCS returns. Its AI-powered platform ensures accurate tax calculations based on your income, expenses, and deductions.

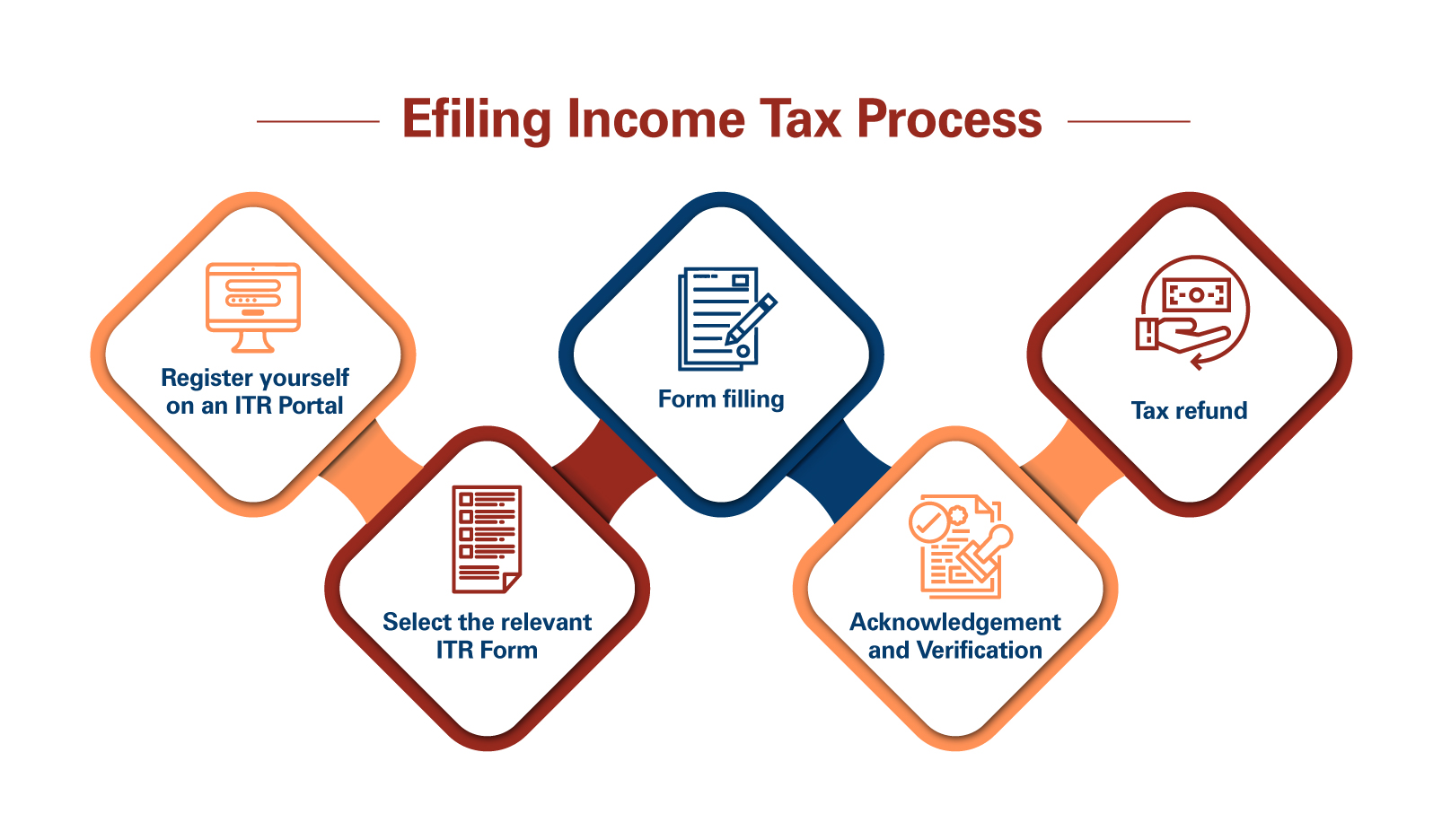

🧾 Steps to File ITR with ComputerMyTax

- Go to the website www.ComputeMyTax.com and login.

- Go to the “E-file” section and select the “Income Tax Return” option.

- Select the assessment year and the “File Online” option.

- If you’re filing for the first time, click “Start New Filing.”

- Choose the appropriate ITR form (such as ITR-1, ITR-2 etc.).

- Enter your income and deduction information.

- Check all the data and click on “Submit”.

- Complete the payment or refund process and verify the ITR.

💰 ComputerMyTax Fee Details

Service Charges (in ₹)

ITR-1 (Salary Return) 750

ITR-2 1500

ITR-3/4 (Business Returns) 2000–2500

CA Certified COI Statement 500–1000

Income Certificate (CA Certified) 1000

🧩 ComputerMyTax’s Key Services

- Online filing from ITR 1 to 4

- Belated Return (ITR-U) Filing

- TDS/TCS Return Filing

- Foreign Income and Crypto Transaction Returns

- CA Certified Computation of Income (COI)

- Salary Return and Business ITR Filing

📍 Why is ComputerMyTax needed in Ahmedabad?

Ahmedabad is a major industrial and commercial city in Gujarat. Small traders, startup founders and professionals here do not have time to understand the tax rules. In such a situation, platforms like ComputerMyTax help maintain their financial transparency and make the tax process extremely easy.

✅ conclusion

Filing Income Tax Return 2024–25 is not just a legal obligation, but it is a testament to your financial honesty. With digital technology and expert support, ComputerMyTax makes tax filing easy, fast, and trustworthy for every taxpayer in India.

❓Frequently Asked Questions (FAQs)

Q1. Is ComputerMyTax a reliable platform for filing income tax returns?

Yes, ComputerMyTax is a genuine and certified online platform operating from Ahmedabad, Gujarat that offers a secure tax filing service.

Q2. Is 24×7 customer support available on ComputerMyTax?

Yes, the customer support service is always active here so that any problem can be resolved immediately.

Q3. Who are required to file ITR?

It is mandatory for every person or business whose annual income exceeds the limit set by the Income Tax Act to file ITR.

Q4. Is ComputerMyTax only for the people of Ahmedabad?

No, this platform is available to taxpayers from all over India. You can file ITR online from anywhere.

Q5. What is the contact details of ComputerMyTax?

📞 +91 93284 66707

🌐 www.ComputeMyTax.com

🏢 310, Anand Milan Complex, Navrangpura Cross Road, Ahmedabad – 380009, Gujarat, India

Q6. Should Indian citizens use this platform?

Absolutely, it is a secure, fast and expert guidance platform for every Indian taxpayer.